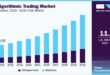

Algorithmic trading, also known as automated trading, uses computer programs that trade based on pre-programmed …

Read More »A Comprehensive Guide to Overbought and Oversold Conditions

The stochastic oscillator is an increasingly popular momentum indicator used in technical analysis. You can adjust its parameters such as its period (%K and %D values) but most trading strategies use their default settings of 14 days each for both. Lane describes that the Stochastic Oscillator measures the speed of price action movement rather than its direction, and can detect …

Read More » BigProfit Profit through Algo & Technical Trading

BigProfit Profit through Algo & Technical Trading